COMMODITY OR SECURITY? The Draxlar Howey Test Conundrum.

COINBASE TRIAL Current position. Charging Coinbase with failing to register its crypto asset trading platform and staking service, the SEC has until October 3 2023 to respond to Coinbase’s opening brief.

IN A NUTSHELL Bitcoin apart, blockchains are centrally controlled. Is this enough for altcoins like Ether to be classed as securities, requiring exchanges like Coinbase to be SEC registered?

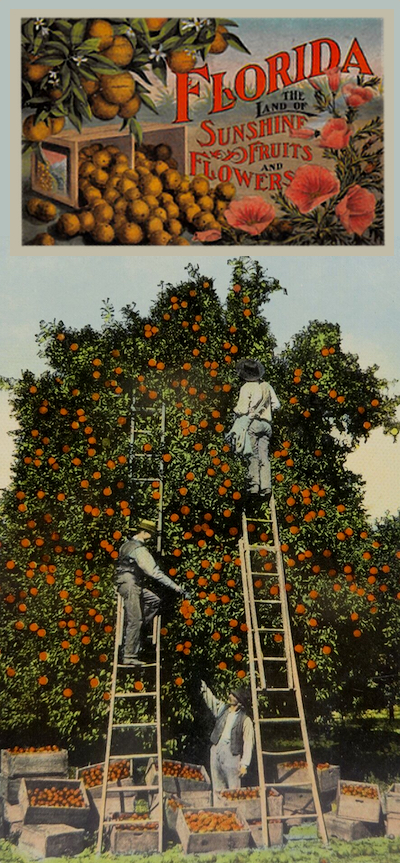

BACKGROUND Seeking to kill off crypto, Democrat SEC Chair Gary Gensler has stonewalled Coinbase’s many requests to provide a means of compliance. Stating the dollar is digital and there is no need for crypto or crypto legislation, Chair Gensler has taken 50 enforcement actions based on the Florida orange grove four-part Howey Test that requires a security to be:

1. an investment

2. in an enterprise

3. expecting profits

4. from efforts of others.

ORANGE GROVES TO CRYPTO

William John Howie, Florida's leading Republican tycoon died in 1938 having built a fortune in orange groves. In 1946 Truman’s Democrat SEC sued the W J Howie Company for selling parcels of orange grove land, with orange growing service contracts and a share of the profits, to naive rich East Coast holidaymakers visiting the orange groves.

This was judged to be selling shares in orange cultivation (securities) without registering with the SEC. Democrat Judge Felix Frankfurter did not agree with his six colleagues guilty verdict.

The result was the four Howey tests, sometimes seen as a Democrat/Republican divide, which Chair Gensler deems sufficient to put the crypto genie back in its bottle. Unfortunately genies are not that obliging and what genie would be with London’s FCA, its one Financial Conduct Authority, drafting crypto law to welcome genies?

Back in Wonderland, with the merest hint of a Cheshire Cat smile, Chair Gensler means what he says but won’t say what he means. Implying Ether is a security but not saying so, allows him to order decapitations with the zeal of the Queen of Hearts and no fear of acting ultra vires, so long as Tweedle Dems and Tweedle Gops are as confused as the Mad Hatter, March Hare and Dormouse...

In 2018 SEC and finance director Bill Hinman stated that according to the Howey Test, Ether is not a security.

In 2023 NY State Attorney General Letitia James stated Ether is a security.

In reply CFTC chair Rostin Behnam said Ether is a commodity.

The curtain rose again on July 13 2023 for the Coinbase trial where one aspect of the defence is that Coinbase never declared or paid a cash dividend and does not intend to.

With Machiavellian mischief, worthy of the devious Court of Draxfort (rotten to the core), I pose this enigma for Judge Rearden and all involved with crypto legislation to consider:

THE DRAXLAR CONUNDRUM

Could a movie turn a free draxlar token into a security?

Would a free inclusive commodity of no initial value be regarded as an exclusive commodity and security if it accrued value due to intellectual association alone with an enterprise having investments expecting profits from the efforts of others?

The draxlar is a fictional coin in the young adult satirical novel The Saga of Draxfort, which aims to do more than entertain. Explaining banking crisis and the gold standard, draxlars are central to the villainy and corruption of Draxfort’s fashionable, debt-ridden, dysfunctional court.

To promote the saga, 10,000 Free FMS ERC-1155 draxlar tokens have been created on the Polygon blockchain with a 5% creator royalty on the secondary market.

The intention is to deposit a draxlar, absolutely free with no fees, into the Metamask wallet of any buyer of The Saga of Draxfort, paperback or Kindle, who requests one.

Unlike Howey orange groves, being free with no fees and of no initial monetary value, Draxlars are not shares and like Coinbase pay no dividend. So not being an investment, draxlars fail the Howey Test for securities at first hurdle.

However Draxfort is more than just a book, the Kingdom of Draxenland has been totally imagined in Minecraft to work out plots and stunts and will soon be appearing on Youtube. Being a saga, Draxfort introduces many characters and storylines to expand into a huge movie franchise or long form tv series that can go on for years.

Giving away 10,000 draxlars one at a time will involve much time and effort as well as patience on the part of recipients if there is a deluge of book sales. Apart from that there will be no ‘efforts of others,’ no tending and harvesting of orange groves, when 10,000 draxlars are gone, they’re gone.

To obtain a draxlar would then require investing in the secondary market. Any expectation of profits would, like Coinbase, come from movement in the market itself, but also by association with the intellectual property - The Saga of Draxfort books, movies, tv and merchandise, all the efforts of others, but separate enterprises, so not enough to turn commodities into securities.

However if author or studio held draxlars and Draxfort sequels boosted draxlar’s price, would this provide Howey’s ‘efforts of others’ for a commodity to become a security?

Coinbase has no such advantage or complexity. It is not associated with any intellectual content and unlike Howey’s parcels of orange grove with their harvest dividends, Coinbase pays no dividend. The Coinbase price is exclusively dictated by market forces like any commodity, and not ‘the efforts of others,’ who tend orange groves to share in a better harvest.

Creators, investors and exchanges need clear law, hard guidlines and simple compliance, not hold-ups, hunches and guesses based on Florida orange grove speculation.

If Chair Gensler’s right, and he may well be, that crypto exchanges, clearing houses and broker-dealers should be separate entities, that requires law. Addressing the future rather than stonewalling, the bi-partisan Lummis-Gillibrand bill advocates most crypto be overseen by the CFTC.

Alternatively just follow London. It had Danelaw in 1016, two hundred years before Magna Carta. However King Canute couldn’t turn back the tide and despite doing penance at the CFTC and SEC for making a fortune at Goldman Sachs, the same goes for Chair Gensler. Instead of trying to hold back the tide, crypto with its instant low-cost money transfer is the future and London aims to harness it.

Colin O’Donoghue

Creator of the Saga of Draxfort, the Draxlar and Draxfort NFTs.

Buy The Saga of Draxfort paperback or Kindle and claim one of 10,000 souvenir draxlars absolutely free with no fees whatsoever. However if you sell, a 5% royalty is charged.

(Unfortunately AUDIBLE sales are too complex to include.)

Offer ends 12.00pm 31 December 2023 or once all 10,000 draxlars have been requested. Any remaining draxlars may be sold.

You will need an OpenSea Polygon Matic account and empty Metamask wallet. Both require account holders to be over 18 years of age but cost nothing to open and no gas or other fees are charged to receive your draxlar. What to do:

1. Buy The Saga of Draxfort, Kindle or paperback from Amazon.

2. After 31 days come back here: www.draxfort.com

3. Click SEND MY DRAXLAR and follow the email instructions.

4. You agree not to return The Saga of Draxfort to Amazon.

5. You include The Saga of Draxfort order confirmation that Amazon emailed you.

7. On receiving your draxlar you agree to move it to a new wallet and close the empty Metamask wallet.

NOTE: Unlike securities requiring investment and NFTs being unique, the draxlar, is a fungible memento souvenir (FMS) ERC 1155 token and commodity according to the ‘Howey Test’ and may or may not acquire monetary value. Nothing here is financial advice.